Browse our Blogs to learn more about

Wealth Management & Retirement Planning!

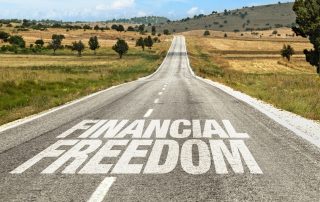

How to Achieve Financial Freedom

The difficult thing about “financial freedom” as a concept is that many people define it in a vague way. Most people think of it as not having to worry about money and being able to have the things they want without having to scrimp and save for them. But there are all sorts of things that cause worry in regard [...]

Defined-Benefit vs. Defined-Contribution Plans

The following two types of retirement savings methods may sound similar, but there are a lot of important differences that might be useful for you to know if you’re looking to get a better understanding of what retirement might look like for you. Defined-Benefit Let’s start with a defined-benefit plan. These types of plans commonly come in the form of [...]

Inflation May Finally Be Slowing Down!

Inflation has been a hot-button issue in finance and politics lately. You may have noticed changes in inflation yourself if you went to buy something and it was much more expensive than you expected. Eggs are a great example of this.[1] In 2022 the price of eggs went up by 59.9% due to an outbreak of avian influenza. Another factor [...]

Retirement Tax Strategies to Consider

How you handle taxes and when you are taxed are two of the most important factors when it comes to retirement planning. If you are putting together the puzzle pieces of your retirement plan and you are curious about some strategies related to taxes and retirement, here are some possible options: Consider a Roth IRA Roth IRAs allow you to [...]

Using Your House to Fund Your Retirement

It is possible for a person to end up in a situation where they have a lot of money in a home but don’t have a lot of money in the bank. If you have been paying off your mortgage for years, your equity in the home could amount to a lot of money. But that isn’t money you can [...]

The National Debt Ceiling and How it Could Affect You

What is the Debt Ceiling? The national debt ceiling is the amount of money that the United States Government is allowed to borrow to pay for its expenses. These expenses include things like Social Security and Medicare benefits, tax refunds, military salaries, and interest payments on outstanding debt the nation may have. The United States runs a budget deficit, meaning [...]

Creating and Maintaining Generational Wealth in Retirement

In today’s fast-paced world, ensuring financial stability for future generations can be a daunting task. However, it is a common goal for retirees to create and maintain generational wealth in retirement. What better way to leave a legacy than to provide financial security? That’s why this article will provide valuable tips and insights to help retirees build a legacy for [...]

Banking Sector Issues and Your Finances

In recent months there have been 3 major bank shake-ups: Silicon Valley Bank (SVB), Signature Bank, and First Republic Bank.[1] This has generally led to fears that there is a larger recession on the horizon. The financial crisis of 2008 was also precipitated by bank collapses, so this has many experts watching the market carefully. The main concern is that [...]

Interested In Gentz Financial Services?

Browse Our Services To See How We Can Help!